First-Time Home Buyer Guide for New Immigrants

Buying a home can be one of the most exciting and rewarding experiences in life, but it can also be a complex and intimidating process, especially for first-time homebuyers. As a real estate lawyer and broker with years of experience, I understand the challenges that come with navigating the real estate market. That's why I've compiled a comprehensive guide with 30 essential things that every first-time homebuyer should know. Whether you're looking to buy a house or a condo, this guide will provide you with a step-by-step roadmap to help you make informed decisions about the type of property you want, the key steps in the home buying process, and the factors to consider when selecting a home.

1. Determine Your Budget

Before you start looking for a home, it's important to determine how much you can afford to spend. Your budget should take into account your income, expenses, and any debts you may have. If you're new to the US, you may want to consult with a financial advisor to help you understand the US financial system and how to manage your finances. You can also use an online mortgage calculator to get an estimate of how much you can afford, but it's also a good idea to talk to a lender to get pre-approved for a loan. This will give you a more accurate idea of your budget and help you narrow down your search.

Factors to Consider:

Your current income and expenses

Your future earning potential and job stability

The amount of debt you currently have

Your credit score and history

The down payment you can afford

The monthly mortgage payment you can afford

Other expenses associated with owning a home, such as property taxes, insurance, and maintenance costs

The type of mortgage and interest rate you qualify for

Financial Options:

Traditional mortgages with fixed or adjustable interest rates

Government-backed loans, such as FHA, VA, or USDA loans

Down payment assistance programs, which provide grants or loans to help with the down payment or closing costs

Mortgage insurance, which can help lower the required down payment but adds an extra cost to the monthly mortgage payment

Co-signers, which allow another person with better credit or more income to help you qualify for a mortgage

Homebuyer education classes, which can provide valuable information and resources for first-time homebuyers.

Financial Assistance Programs:

FHA loans: These loans are backed by the Federal Housing Administration and often require a lower down payment and credit score than traditional loans.

USDA loans: These loans are for homes in rural areas and offer low-interest rates and no down payment.

VA loans: These loans are for veterans and offer low-interest rates and no down payment.

First-time homebuyer grants and tax credits: These vary by state and can provide financial assistance to first-time homebuyers.

2. Research Neighborhoods

Once you have determined your budget, start researching neighborhoods that fit your lifestyle and budget. Consider factors such as the crime rate, school district, proximity to public transportation, and the availability of amenities like grocery stores, restaurants, and parks. As a newly immigrated individual, you may want to look for neighborhoods with a diverse community that can help you feel more connected to your new home. Look online for resources like neighborhood guides and real estate websites that can provide you with information about specific neighborhoods.

Think about your lifestyle and what amenities you want to be close to, such as schools, parks, shopping centers, restaurants, public transportation, and healthcare facilities.

Consider the commute time and transportation options to your workplace or other places you frequently visit.

Look for neighborhoods that match your budget and housing preferences, such as single-family homes, condos, or apartments.

Research the crime rate and safety of the area, as well as the quality of the local schools and their ratings.

Check the property values and the overall real estate market trends in the area.

Visit the neighborhoods you're interested in and take a tour to get a feel for the community and the local culture.

Talk to your real estate agent or other locals to learn more about the neighborhood's history, culture, and any ongoing or future development plans.

Take advantage of online tools and resources, such as Google Maps, Zillow, and other real estate websites, to research and compare neighborhoods based on factors such as crime rate, school ratings, and affordability.

Attend open houses or schedule private tours of homes in the areas you're considering to get a better sense of the properties available in those neighborhoods.

3. Hire a Real Estate Agent

Hiring a real estate agent can be a valuable resource, especially for first-time homebuyers who are new to the US. An experienced agent can help you navigate the home buying process, provide you with valuable insights about the local market, and negotiate on your behalf. You can find a real estate agent by asking for referrals from friends and family, searching online, or contacting your local real estate board.

Look for an agent with experience and good reviews.

Check their credentials and make sure they are licensed.

Communicate your needs and preferences clearly.

Don't be afraid to ask questions and express any concerns.

4. Find the Right Home

When you start looking for a home, be sure to keep your budget and priorities in mind. Your agent can help you find homes that fit your criteria and schedule showings for you. When you visit a property, be sure to take note of any repairs or upgrades that may be necessary and consider how much those repairs would cost. As a newly immigrated individual, you may want to look for homes that require less work so that you can focus on adjusting to your new life in the US.

Types of Homes and Neighborhoods:

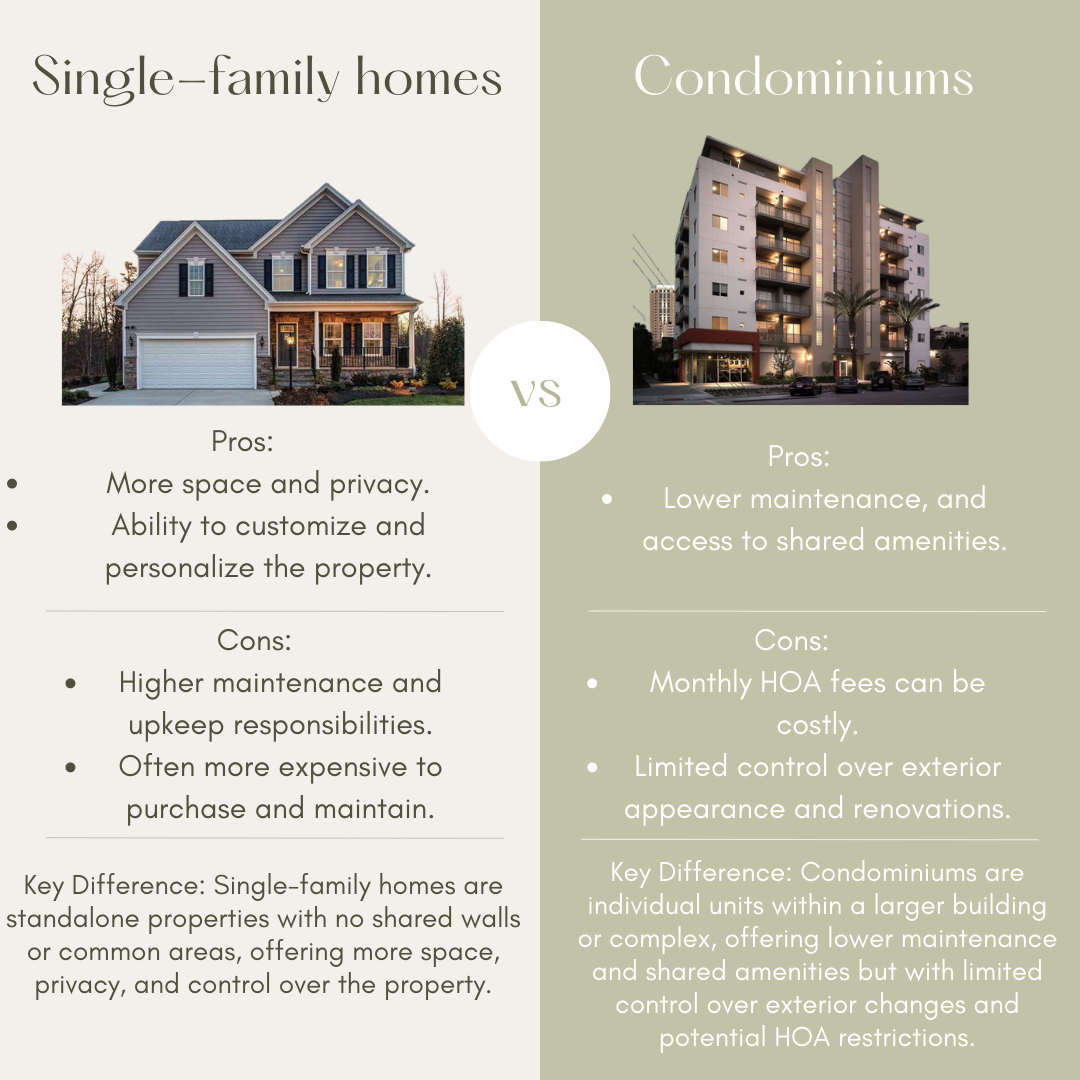

Single-family homes: These are standalone homes that typically have a yard and are ideal for families or those who want more space and privacy.

Condominiums (Condos): These are units within a larger building or complex and often include shared amenities such as a pool or gym. They are often lower maintenance than single-family homes but also come with HOA fees.

Housing co-operative (“co-ops”):

Condos and co-ops are both multi-unit buildings consisting of apartments, which can often be confusing for first-time home buyers. While they share this similarity, the key difference lies in the ownership structure. Condo ownership involves individual deeds for each unit and shared ownership of common elements, while co-op ownership entails proprietary leases and shares in a nonprofit corporation that owns the entire building.

Townhouses: These are attached homes with multiple levels, similar to a row house. They often have a small yard or patio and are a good option for those who want more space than a condominium but want to avoid the maintenance of a single-family home.

Suburban neighborhoods: These are typically quieter, family-oriented neighborhoods with good schools and a lower cost of living.

Urban neighborhoods: These are more densely populated areas with a higher cost of living, but often have more entertainment options and a vibrant community.

5. Make an Offer

Once you find a home you like, work with your real estate agent to submit an offer. This involves negotiating with the seller on price and other terms of the sale.

Include contingencies in your offer, such as financing, inspection, and appraisal, to protect yourself in case issues arise during the transaction.

6. Get a Home Inspection

Before closing on the home, it's important to get a home inspection. An inspector will evaluate the home's condition and identify any issues that may need to be addressed. This can include problems with the foundation, plumbing, electrical system, and more. If the inspection reveals any major issues, you may be able to negotiate with the seller to have them fixed or to lower the price.

7. Close the Deal

Once you have negotiated the terms of the sale and the home inspection has been completed, it's time to close the deal. This involves signing the final paperwork, paying closing costs, and transferring property ownership. It is essential to understand the legal aspects involved in closing the deal. As a law firm specializing in real estate transactions for newly immigrated individuals, we are here to guide you through this crucial phase.

Understanding the Closing Process:

The closing is a legal transaction where the final paperwork is signed, and ownership of the property is transferred to you. Typically, the closing takes place at a title company, attorney's office, or escrow company. During the closing, the buyer, seller, real estate agents, and potentially a representative from the mortgage lender are present. The process involves reviewing and signing various documents, paying closing costs, and completing any remaining paperwork necessary for the transfer of ownership. Closing the deal is a significant legal transaction where ownership of the property is officially transferred to you, the buyer. Our experienced attorneys will be by your side to ensure that all necessary documents are reviewed, explained, and executed correctly.

Mortgage Implications:

If you secured a mortgage to finance your home purchase, closing the deal involves signing the mortgage documents. These documents outline the terms of your loan, including the interest rate, repayment schedule, and consequences for non-payment. It's crucial to carefully review and understand the terms before signing. Our team will carefully review the mortgage documents with you, explaining the terms, interest rate, repayment schedule, and the consequences of defaulting on your mortgage.

Documents at Closing:

At the closing, you will be required to sign various documents, including the promissory note, which is the legal agreement to repay the mortgage loan, and the mortgage or deed of trust, which secures the loan with the property as collateral. Additionally, you may need to sign documents related to the transfer of ownership, such as the deed and the statement of closing costs. Our attorneys will ensure that you understand the legal significance of each document before signing.

Closing Costs:

Closing costs encompass various fees associated with the purchase of a home, including appraisal, loan origination, title search, title insurance, and attorney fees. These can add up to several thousand dollars and are usually paid by the buyer. It is crucial to have a clear understanding of these costs, as they can amount to several thousand dollars. We will provide a comprehensive breakdown of the closing costs and answer any questions you may have regarding their purpose and allocation.

Property Taxes:

As a homeowner in the US, you will be responsible for paying property taxes. Property taxes in the US vary by state and are typically based on the assessed value of the property. Homeowners are responsible for paying these taxes, and they can range from a few hundred to several thousand dollars annually. Our attorneys will guide you through the legal obligations and considerations related to property taxes, ensuring that you understand the process and associated costs.

Homeowner's Insurance:

Obtaining homeowner's insurance is required by most lenders and protects the homeowner in case of damage or loss to the property. The cost of homeowner's insurance varies by location, type of home, and coverage amount. Our legal team will assist you in navigating the complexities of homeowner's insurance, including understanding coverage options, policy terms, and associated costs.

Legal Obligations and Down Payments:

A down payment is a portion of the home's purchase price paid upfront. It is typically required by lenders and can vary based on factors such as the loan type, lender requirements, and your financial situation. The down payment amount is usually a percentage of the home's purchase price, and a larger down payment can result in lower monthly mortgage payments or better loan terms.

Non-payment consequences: Failing to pay your mortgage can have serious consequences, including foreclosure. If you are unable to make your mortgage payments, it's important to communicate with your lender as soon as possible to explore options such as loan modification or refinancing. It's crucial to understand your obligations and the potential impact of non-payment to protect your investment and creditworthiness. Xu Law Group will provide comprehensive guidance on your legal obligations as a homeowner, including complying with local laws, maintaining the property, and understanding your rights and responsibilities. Additionally, we will guide you through the process of making a down payment and explain the legal implications of down payments to assist you in understanding the amount required and its impact on your mortgage terms.

Required Documentation:

Throughout the home-buying process, you will need to provide various legal documents. These may include identification, proof of income, bank statements, employment verification, and documentation related to your immigration status. Our attorneys will ensure that you have all the necessary documentation in order and that it is properly prepared for a smooth closing process.

8. Move In

Congratulations, you're a homeowner! Once you have closed on the home, it's time to move in. Moving into a new home can be both exciting and overwhelming. Before moving day, it's important to plan ahead and make a checklist of tasks that need to be done, such as changing your address, setting up utilities, and scheduling any necessary repairs or renovations. On moving day, make sure to label boxes clearly and keep important items like keys and paperwork in a safe and easily accessible place. Below are some important factors to consider after moving in:

Homeowners insurance: Obtain a suitable homeowners insurance policy to protect your investment from potential damage or loss.

Property taxes: Research local property tax rates and factor them into your ongoing expenses as a homeowner.

Homeowners association (HO) fees: If you're purchasing a property within an HOA, be prepared to pay monthly or annual fees for shared maintenance and amenities.

Utility costs: Investigate average utility costs for your chosen area and property type, including water, electricity, and gas.

Home improvements: Consider the costs of any desired home improvements or renovations, such as updating kitchens, bathrooms, or adding additional living space.

Resale value: Keep in mind the potential resale value of a property when making a purchase, especially if you plan to move again in the future.

Local market trends: Stay informed about local real estate market trends, such as supply and demand, inventory levels, and price fluctuations, to help guide your decision-making.

Emergency funds: Set aside an emergency fund for unexpected expenses, such as repairs, maintenance, or other financial setbacks.

Long-term goals: Consider how a home purchase aligns with your long-term financial and lifestyle goals, such as starting a family, changing careers, or retiring.

Finally, take a moment to appreciate your new surroundings and make the space your own.

Buying a home for the first time can be an exciting and overwhelming experience, but with the right preparation and guidance, it can also be a smooth and rewarding process. Remember to take your time, do your research, and work with experienced professionals to help you find the perfect home for your needs and budget.